April/May 2025

Hi all and Happy Spring!

This image was captured just a few weeks ago at The Gardens, a luxury condominium community in Rhinebeck. It features one of the most vibrant, full rainbows I’ve ever seen (Maui still holds top spot, but this was a solid second.) This was a quiet reminder that living upstate encourages a slow down (still working on that) and look up to embrace the beauty that surrounds us. We nearly drove past without notice. Then others stopped, curious at what had our attention. Within moments, a handful of strangers stood with phones out smiling wide enjoying this arc of color in the sky.

The farmers markets are readying to come back to life, magnolias are in full glory and daffodils and buttercups sweep the landscape in golden waves. Let’s hope this seasonal revival encourages sellers to step into spring market and allow their homes to shine as well. I’m optimistic that May will spark some much needed momentum in the inventory gridlock our region has been experiencing as motivated buyers continue to wait in the wings. Across the Hudson Valley, seller’s market conditions persist with well-priced and strategically marketed homes generally moving swiftly.

There’s a subtle sense of optimism in the air – even as the market remains constrained by limited inventory. The usual spring buzz has been more a soft hum than a roar – punctuated, of course, by an unexpected late-season snowfall (seriously?!) I’m committed to making May a strong and successful month, guiding clients with strategy, insight and care. If you or someone you know are thinking of making a move – whether buying or selling – I’d be honored to be part of the journey. I take great pride in delivering exceptional service to those who place their trust in me.For years, I’ve produced custom market momentum reports that dive far deeper than standard data sources, uncovering insights and patterns in local markets that others often miss. This depth of knowledge, paired with continuous research, enables me to offer the level of expert guidance I believe my buyer and seller clients deserve. It also serves as the foundation for the insights I share in The Brick. I am trying to keep the issues concise, but there’s quite a bit going on in the market. If you would take a moment to share feedback in the “To be or not to be” section, it would be greatly appreciated.What brought Mary Poppins to mind in the context of the housing market? I’m not entirely sure, but she seemed to capture the question hovering in the air. I’m not suggesting a crash is imminent, nor do I believe one is coming in the foreseeable future in our area. However, I do sense that something is on the horizon, something that will trigger a more pronounced shift in the market.

If you want to lean in, imagine a mysterious tone:

“Winds in the east,

There’s a mist coming in,

Like something is brewin’,

And ’bout to begin.

Can’t put me finger on what lies in store,

But I feel what’s to happen all happened before.”

What’s on tap:

- Market Dynamics

- Pricing

- Inventory: The Root of Demand

- New Construction

- To Be or Not To Be?

- Expired Listings: A Reality Check

- Big Sky

- Five Days to Done

- Featured Outing – Blue Hill

- Color Trends – Warm is In!

- What Clients Say

- Lux

- My Why Squared

Let’s jump in…

Market Dynamics

Real estate markets nationwide are increasingly defined by hyperlocal dynamics. Rather than relying exclusively on regional, state or even county data, a deeper story can often unfold at the more granular level – price points and sectors within municipalities. That’s the level of data gleaned from my market momentum reports. Reach out if you would like one for your municipality.

A good example of current performance disparity in our area is in the $1,000,000+ segment in Dutchess County. These numbers are fluid and subject to change based on sales activity, but in the moment the only municipalities showing in sellers market condition in the $1,000,000+ price points in Dutchess County are Clinton, East Fishkill, Red Hook and Rhinebeck. All other municipalities are showing buyers market conditions as defined by 8 months+ from active to sold.

For one, the Town of Poughkeepsie is at 24 months. This type of intel is relevant in client guidance. I would counsel a $1,000,000+ client in Red Hook realizing two months from active to sold (sellers market conditions) differently than I would counsel a $1,000,000+ client in the Town of Poughkeepsie with 24 months from active to sold (buyers market conditions.) I attribute this heightened market pulse as a prong in the success my clients consistently realize with their sales.

On a nationwide basis, striking market contrast can be found in Florida, which appears in spiral in certain market segments. Condo and townhome prices have fallen in 92% of Floridas markets, per ResiClub Analytics. The culprit appears regulatory and insurance pressures. In some cases, the influx of new construction communities has further disrupted local dynamics, leaving select neighborhoods eerily under occupied, resembling modern day ghost towns. Conversely, the $10M+ market is flying off the shelves in many parts of Florida.

There’s no question we’re navigating a complex and evolving landscape. Wildcards are on the table. February’s Wall Street bonuses were generally strong – a traditionally positive signal for discretionary spending in the Hudson Valley with New York City historically serving as a primary feeder market.

The peak of luxury sales in Dutchess County – measured by units sold – was achieved in both 2021 and 2024, with 119 single family detached properties above $1M closing each year. For perspective, just 26 luxury properties sold in 2018 and 25 in 2019. It would seem luxury is poised for another strong year, but is it?

Days on market from active to sold have increased across most Dutchess County municipalities in the $1M-plus segment. Currently 18 out of 22 municipalities reflect buyers market conditions in the luxury tier with on Clinton, East Fishkill, Red Hook and Rhinebeck currently the only municipalities showing in sellers market conditions for that sector.

These conditions remain fluid, shifting in response to sales activity. A surge in high-end transactions could tip the scales. Still, the question remains: will 2025 close as another banner year for luxury, or has recent volatility and uncertainty introduced enough hesitation to keep much of this market in buyer’s territory? How might broader economic and geopolitical developments shape buyer confidence across price points and particularly among those reliant on financing?

We’re also seeing a shift in household dynamics. Will more families begin living together to manage housing costs as projected? Will the boomers, representing the largest housing market segment of home sellers at 53% and 42% of homebuyers, increasingly choose to age in place? And perhaps the most pressing question: where will the inventory come from to meet the needs of today’s ready-but-waiting buyers? With a general lack in new construction in our area, there’s only one place I can see increased inventory coming from: decreased demand.

What will ultimately be the trigger that opens the inventory gate? There are far more questions than answers in the moment, but the answers are coming. We know what is now. Now, the Northeast, generally speaking, and certainly the Hudson Valley, are in overall sellers market conditions.

Pricing

For the first time, all counties in the Hudson Valley now have median prices above $300,000 for single family detached, according to the latest annual housing report from Hudson Valley Pattern for Progress. According to the same report, Sullivan County has realized the most dramatic increases with prices more than doubling over the past six years. Median home prices for single family detached have reached new peaks in every Hudson Valley county, with Westchester topping them all. In March, 2025, YOY median sales prices hit $937,000 per OneKeyMLS. How high is high?

Municipalities found new and increased price points during and since the pandemic. While many did not realize sales above $1M prior to the pandemic, now every one of the twenty two municipalities in Dutchess County has except one. The City of Poughkeepsie has not yet had a sale over $1M in the history of the MLS, per OneKeyMLS, but there have been some that have tried. The latest entrant just entered the market in April. Will this be the one? Here it is. If you are interested in specific performance in your municipality over this past year and where it stands now, reach out to me.

A projected national price increase of 2.8% for 2025 reflected the combined outlook of 22 leading financial institutions, industry associations and organizations. However, the Hudson Valley is poised to exceed that benchmark as the national forecast includes areas currently navigating buyers market conditions. That said, I anticipate growth in our region to be measured and steady with hopes we make our way toward greater stability on multiple levels.

Inventory: The Root of Demand

This has been and continues to be about supply and demand.

According to Realtor.com, all four major US regions experienced inventory growth in March – though the pace of that growth varied significantly. Inventory in the West and South rose by 40.3% and 31.1% respectively – bringing those areas close to pre-pandemic levels seen from March 2017 to 2019.

The Midwest saw a more moderate gain of 17.7%, while the Northeast posted the smallest increase of 11.3%.

As inventory increased in the West and South, their market conditions shifted to neutral or buyers market conditions. With far less inventory growth in the Midwest and Northeast, both regions continue to hold in sellers market conditions.

The market types featured in this image are most relevant for properties below $1,000,000. In normal trending, which we have not seen since pre-pandemic – luxury historically took longer to sell through than non-luxury listings with a month added into each condition type for lux sell through. The image shares how time from active to sold defines market condition type.

While Dutchess County has more municipalities down March 31,2025 YOY in sales, these municipalities realized an overall sales increase over the same period: Beacon (+5%), Dover (+22%), Milan (+37%), Pawling (+10%), City of Poughkeepsie (+11%), Red Hook (+9%), Stanford up a whooping 72% from with luxury being a solid contributor to that growth, Wappingers (+3%) and Washington (+31%).

Overall, both sales and inventory declined year over year across most municipalities in the $0-$450,000 range. Buyers searching below $450,000 will likely find the highest selection in these municipalities,

Top Five Municipalities in Sales 0-$450,000 in Dutchess County. April 2024-April 2025:

- Town of Poughkeepsie (278 units sold)

- City of Poughkeepsie (163 units sold)

- Wappingers (137 units sold)

- Hyde Park (135 units sold) and

- Fishkill (119 units sold)

New construction

Texas and Florida hit top of list in new construction starts throughout the country, per National Mortgage News. By the same study, Colorado ranked in the top five of overall housing growth 2013-2023. Now all three states lead the pack in buyers market conditions. Empty not yet purchased homes are a pure expense to builders.

We need more affordable housing options yet according to the National Association of Home Builders, tariffs can add $7500-$10000 to the cost of building a single family home. According to an “Immigrant Construction Workers in the US” September, 2024 forum, 25-30% of the construction labor force in the US is made up of immigrants. The US Census Bureau reported construction as #3 of immigrant professions making up over 11% of employment in this sector in the US.

Builders that are subscribers to this newsletter, please touch base with your thoughts. I would be very interested to hear your feedback. As far as I can tell, builders are in a precarious position on multiple fronts.

My aim isn’t to be political, but simply to highlight the facts – certain issues have the potential to further strain an already fragile housing landscape.

To Be or Not to Be?

A quick question for you – whether you’re a client, colleague, friend, or simply a thoughtful reader of The Brick, would you prefer to keep receiving this newsletter monthly, or would shorter, more frequent editions be a better fit? I’ve been toying with the idea of smaller, bit-sized updates twice a month – or even weekly, depending on the content.

A friend (and client) suggested the name The Brickette for these lighter editions – what do you think? I’m mindful of your inbox and want to strike the right balance: meaningful insights without feeling like too much. I’d truly value your thoughts on the format, frequency and yes – even the name. Your feedback helps shape this, and I”m all ears. Drop me a line. Thanks!

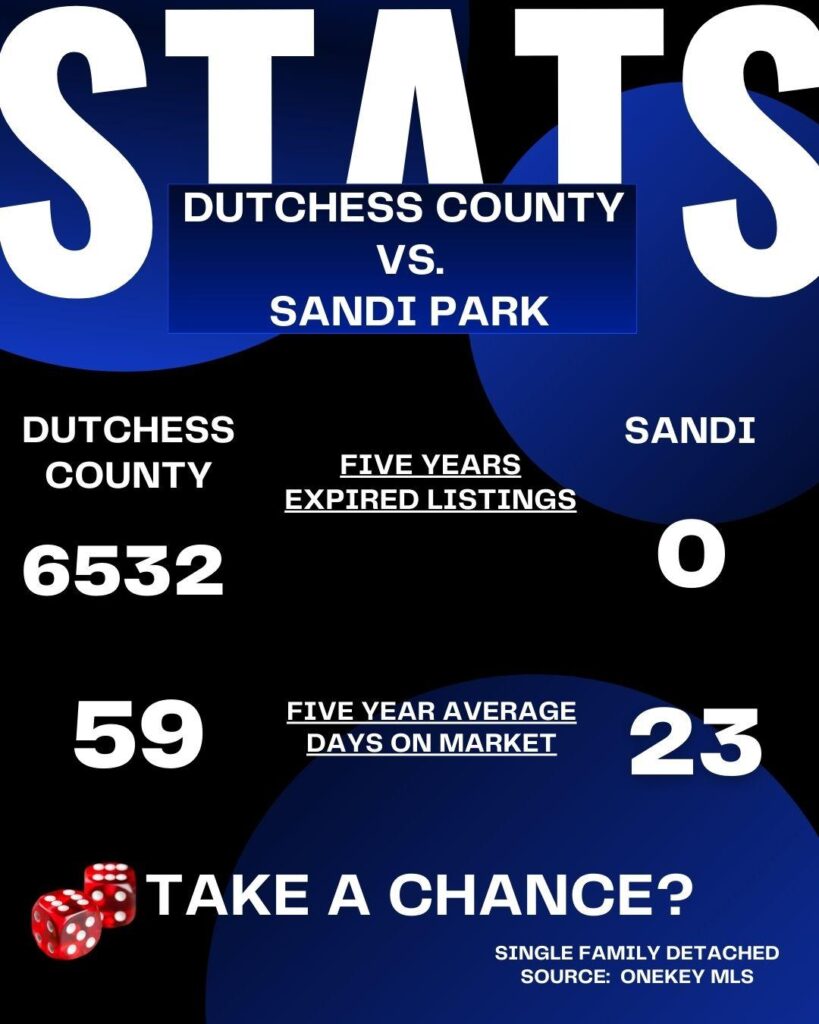

Expired Listings: A Reality Check

Since 2020, the number of expired listings, which has totaled over 6,000 in Dutchess County alone, has steadily declined year over year. However, a concerning trend appears to be emerging. Certain sellers insisting on unrealistic pricing. I anticipate a noticeable rise in expired listings in 2025 and perhaps 2026 if the pricing disconnect continues.

At one point, sellers were energized by rapid price appreciation. Now, some appear to have been conditioned to expect continued growth based solely on past momentum. Here’s the reality: the market has been discreetly adjusting since 2022. Buyers don’t care what you paid, how much you owe or how much you need; they care about market value.

Despite persistent low inventory, overpriced listings typically face one of two outcomes – either they expire (don’t sell during the term of the listing agreement,) or they eventually reduce in price, often by negotiating down with a singular buyer. None of my residential listings have expired over the past five years, but many listings have, this includes during the absolute height of pandemic frenzy.

At the end of the day, sellers can ask whatever they want. It is the buyers that determine value through the sale price, whether up or down from asking. Thoughtful realtor choice and realistic seller expectations can mean the difference of multiple, if not hundreds, of thousands of dollars.

Big Sky – Coming Soon

The first image captures sunset at my soon-to-market luxury estate where peace seems magnified by the interplay of water casting a slight ripple from the pool and pond below, sky and golden light. The panoramic views invite a deep sense of stillness and awe. Set on 22 acres that live like a thousand with unobstructed views to the Catskill Mountains and a sky that feels impossibly vast.

In preparation for launch, I’ve been in conversation with select astronomy groups to host private stargazing evenings – an experience curated specifically for high net-worth buyers and the professionals who serve them, from wealth managers to discerning art advisors. It’s one element in a bespoke marketing approach. This is a property that demands to be experienced at sunset – and into the night. “Big Sky,” a countryside French-inspired residence with over 7,000 square feet of living space, is coming soon in an incredible setting for $2.795.

Five Days to Done

It is always rewarding to incorporate affordable housing into my portfolio. This one moved so quickly that I didn’t have a chance to share it before an offer was accepted. The video overview is below. “Five Days to Done” is a ten second video tracking the listing to accepted offer process.

Town of Poughkeepsie

Hyde Park schools

Crystal Glen community

Showings will continue until contract is fully executed.

Featured Outing: Blue Hill at Stone Barns

Tarrytown, New York

Blue Hill at Stone Barns is more than a restaurant – it’s an experience that unfolds throughout the day, each setting offering its own distinct rhythm and flavor. Begin with lighter, seasonal offerings at the cafe – an accessible and relaxed way to enjoy the farm’s bounty. For those looking to elevate the experience, lunch introduces a deeper dive into Blue HIll’s celebrated culinary ethos, still approachable in both tone and pricing.

Come evening, the journey becomes immersive. Whether in the intimate community dining room or the signature main dining room, dinner at Blue Hill is an occasion – refined, thoughtfully choreographed, and reflective of its two Michelin stars.

It’s a destination worthy of a special moment or even just a walk around the beautiful grounds. The setting, service and cuisine align in extraordinary harmony at Blue Hill.

On a personal note, I’m especially proud of this place – not just for what it represents in the culinary world, but because both of my daughters are a part of it. One contributes to the welcoming energy at the cafe, while the other helps create the seamless dining experience Blue Hill is known for. It’s not easy to land a position here, and I’m incredibly proud of their involvement in such a thoughtful and inspiring environment.

Here’s a short video I captured during my Easter visit.

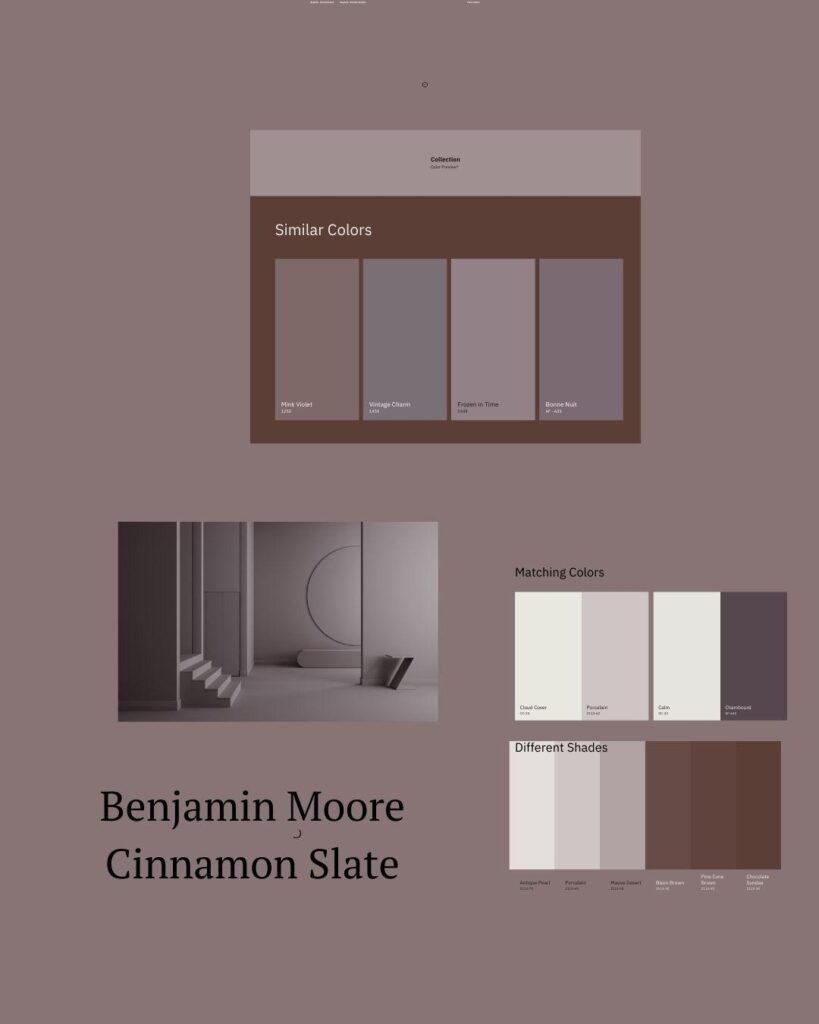

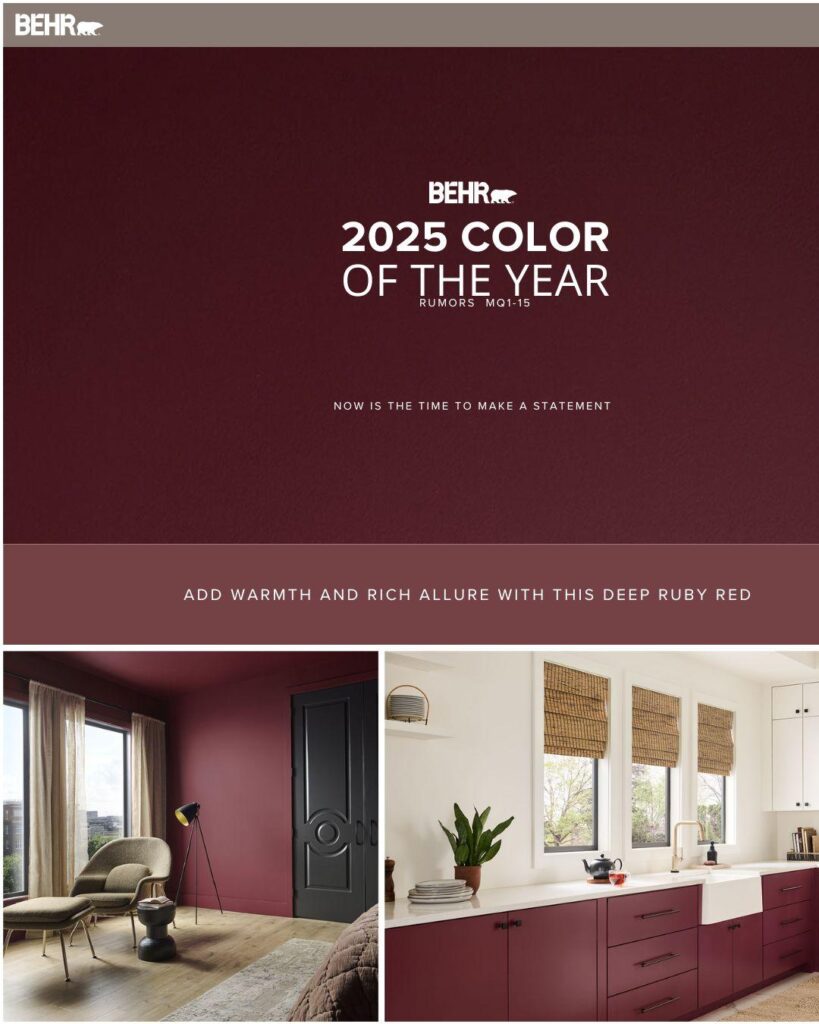

50 Shades of Grey is Out – Warm is in!

Inviting and earthier tones including browns and camel have replaced the cooler grey trend. Once popular cool tones are still present, but warmer hues are gaining influence. Mixing styles is also gaining popularity – modern with traditional as one example.

According to Christine Slater, senior creative director for Vesta Home, the nations largest staging company, it is predicted both chocolate and deep olive will sweep staging motifs this year.

Warmth has been quietly making its way back to interiors. This year the major paint companies leaned in and made it official by selecting warm hues for their Colors of the Year.

The versatile neutral that never goes out of style: beige. Sundrenched by Sherwin Williams and Shaker Beige by Benjamin Moore can be solid beige starting grounds.

Overall, designers seem to agree it’s time to mix things up.

L U X

There is not a specific price point across the board that defines luxury as it can vary greatly by locale or even street within a locale. In Dutchess County, luxury generally starts around $1.2M-$1.5M. Generally, Westchester is noticeably higher. What do you think of these? Are they all luxury to you?

Northern and Southern Westchester and Dutchess.

- Here’s more of a “lean in” in Bedford (Katonah and Bedford are both Town of Bedford)

Let’s compare. Back in 2022, $1,800,000 scored this beauty in Rhinebeck. I represented the buyer and seller for that listing. Here’s the video of the property, as well.

My Why Squared…

Alana discharging from Westchester Medical Center January, 2023.

To the right, tipping the ball playing starting middle with her volleyball club during tournaments. March, 2025.

My oldest, Kylie, is below. It seems she is getting promoted weekly. Her work has become a passion. I get it, Kylie.

Those who thrive on challenge often push themselves beyond their comfort zones – and witnessing that kind of resilience up close is something I’ll never forget. Just over two years ago, my youngest daughter, Alana, spent a week in ICU at Westchester Medical Center, fighting for breath, reliant on continuous oxygen and nearly overcome by asthma. It was a frightening chapter, but she made a powerful decision: that moment would be her turning point.

At 14, she committed herself fully to a healthier lifestyle, shed weight in a strong and sustainable way, and hasn’t needed an inhaler since. Her determination was unwavering. That’s her at the net with a tip that set yet another score.

Both of my daughters have a remarkable ability to set their minds to something and see it through. For that, I am endlessly grateful – and incredibly proud.

They are my why.

If you’re thinking about selling within the next five years, here’s my advice: take a moment to reflect on your reasons for making a move. If you’re clear on your “why.” it may be worth considering whether now is the right time to act. With our local market still favoring sellers, exploring the possibility could help avoid future regret if conditions shift. While no one can predict how long the current climate will hold, what we do know is that today’s market remains overall in seller’s territory.

I anticipate 2025 will further sharpen the divide between the have and have nots – not only among realtors, but also among the professionals who support them and the clients they serve. With inventory still constrained, there’s only so much of the pie to go around, and that scarcity will be felt by buyers and sellers, as well. I expect we’ll see a rise in have-not sellers this year, particularly among those holding firm to unrealistic pricing. While other regions have leaned in to adjustment, it feels like we are in a state of suspension. Something has to give. What’s it going to be?

Look at you making it to the end! Please do keep me in mind for your trusted referrals!

Best,

Sandi